University Microcredential of Legal Considerations in Tax Compliance in the Company + 2 ECTS Credits

Request information

Syllabus

Curriculum

Summary

The current situation in the field of tax compliance is more relevant than ever. Companies face a complex and constantly evolving regulatory environment, where compliance with tax obligations has become a fundamental pillar for business sustainability and reputation. The Legal Considerations in Tax Compliance in the Company course gives you the opportunity to acquire essential skills to navigate this landscape. Through a theoretical and practical approach, you will learn to identify risks, implement preventive measures and ensure regulatory compliance. The demand for professionals specialized in this area is booming, which opens up a range of job opportunities. Don't miss the opportunity to train in a key sector, where your knowledge will make a difference. Sign up and transform your professional future.

Goals

Professional opportunities

To prepare you

O curso Considerações Legais em Conformidade Tributária na Empresa prepara você para enfrentar os desafios fiscais atuais no ambiente de negócios. Você aprenderá a identificar e aplicar os regulamentos que regem o cumprimento das obrigações fiscais, o que lhe permitirá gerenciar riscos e evitar penalidades. Após a conclusão, você estará capacitado para implementar políticas eficazes de compliance tributário, assessorar sua equipe sobre obrigações tributárias e contribuir para a transparência e ética na gestão tributária de sua empresa.

Who is it addressed to?

O curso Considerações Jurídicas em Compliance Tributário na Empresa é direcionado a profissionais e graduados que desejam ampliar seus conhecimentos sobre a regulamentação tributária e sua aplicação no âmbito empresarial. É ideal para quem atua nos departamentos contábil, fiscal ou compliance e busca entender melhor as implicações legais no seu dia a dia.

Our methodology combines technology, pedagogy and empathy for learning tailored to you.

You set the pace, decide the path and artificial intelligence accompanies you so that you learn better, with meaning and purpose.

Truly personalized learning

Your style, interests and level define the route. You are the starting point.

Constructivism in action

Explore, experiment and apply. Learning means understanding, not memorizing.

AI that accompanies you, not directs you

PHIA, our artificial intelligence assistant guides you without limiting your autonomy.

Evaluation without pressure

Continuous and adaptive feedback. Because learning is a process, not a number.

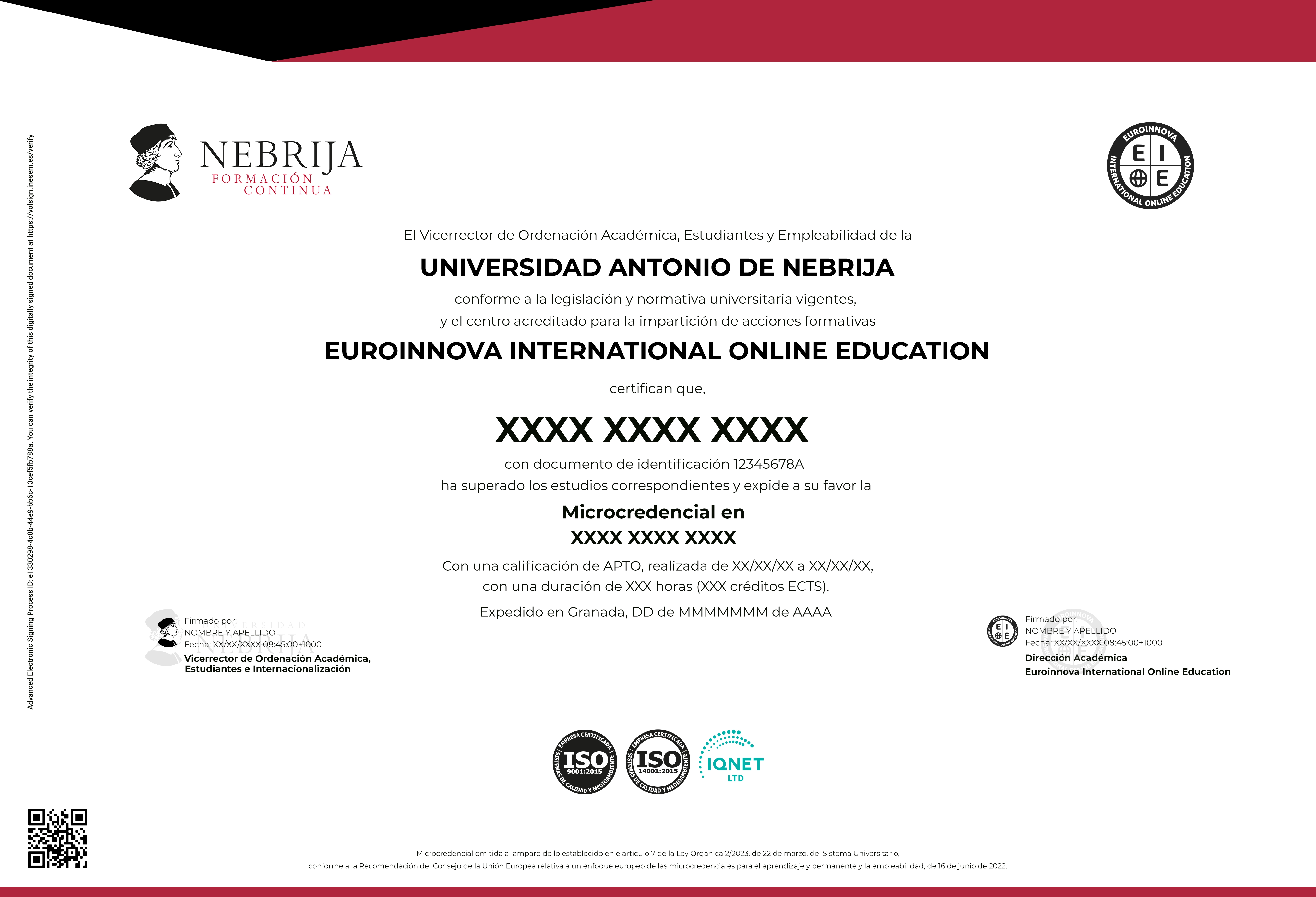

Certification

Microcredencial Universitária em Considerações Legais em Conformidade Tributária na Empresa com 50 horas e 2 Créditos ECTS emitidos pela Universidade Antonio de Nebrija

EducaHub Scholarships

Make your training more accessible: finance at 0% interest and obtain personalized scholarships.

At EducaHub we believe that education should be available to everyone. For this reason, we offer a Scholarship Plan that facilitates your access to practical, current and quality training, eliminating economic barriers.

-25%

Alumni Scholarship: for former EducaHub students.

-20%

Unemployment Scholarship: if you prove that you are unemployed.

-20%

Large Family Scholarship: for families with 3 or more children.

-20%

Disability Scholarship: for people with disabilities ≥33%.

-15%

Emprende Scholarship: for self-employed workers who can prove their activity.

-15%

Recommended Scholarship: if you come recommended by a former student.

-15%

Group Scholarship: for joint registrations of 3 or more people.

An entire educational universe, on a single platform.

An intuitive environment with AI that guides you to train autonomously and with purpose.

Learn at your pace

Courses, master's degrees and official qualifications. 100% online, flexible and at your pace.

Access from anywhere

Available 24/7 on mobile, tablet or PC. You decide when and how to train.

Phia, your AI mentor

It challenges you, motivates you and personalizes your path. Learn with a guide that evolves with you.

LX One Plus: Training without limits

Unlock soft skills, languages and more. Move towards comprehensive and continuous training.